This article is part of a larger series on Payments.

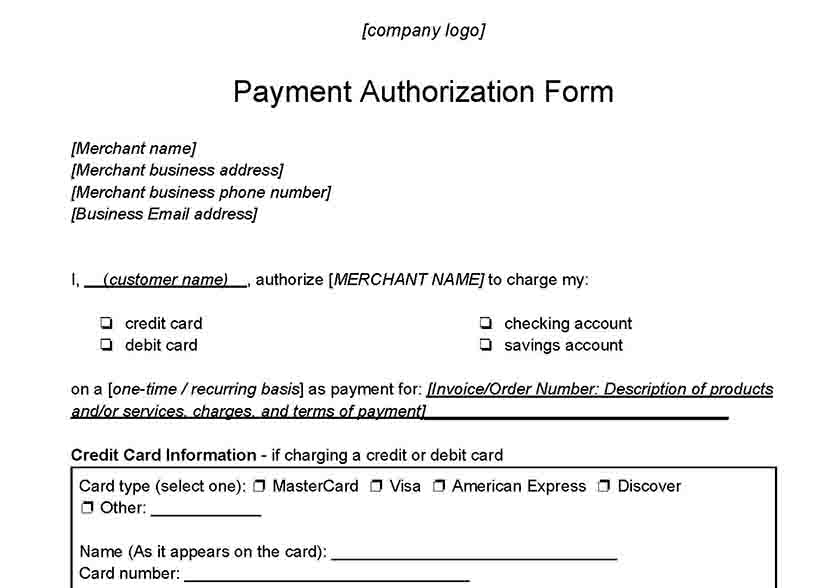

Table of ContentsA credit card authorization form is a formal document that a customer signs to approve a charge to their credit card. It states that the cardholder agrees to the charges set forth by the merchant. You can use credit card authorization forms as documented proof to validate credit card transactions and protect your business from fraud and chargeback claims.

Download our free standard template below and continue reading for more in-depth information on credit card authorization forms, including additional downloadable templates.

FILE TO DOWNLOAD OR INTEGRATE

Payment Authorization Form

Download as Word Doc Download as Google Doc Download as PDF

Want a payment processor with credit card authorization tools and more already built-in? Visit Square to see why it is our top-recommended payment processor.

Select Download TypeIf you’re still unsure if your business is a fit, you can analyze your transaction types instead. You’ll need to have signed credit card authorization forms for:

Recurring PaymentsRecurring payments are required for subscription-based businesses, memberships, and utilities and bills. In a recurring payment business model, customers have to make regular payments to businesses. However, this means they have to remember to make those payments. Learn more about recurring payments.

When you have a credit card authorization form, you can use language that permits you to charge the customer’s card without requiring their permission each time. Usually, some form of automation is involved through your point-of-sale (POS), invoicing, or payment software, which helps ensure you receive the payments on time.

Did you know? Some POS systems and payment processors like Square offer free authorization forms and templates you can easily customize and send to your customers. This is just one of the many reasons Square is our recommended payment processor for small businesses. Visit Square to learn more.

Card-not-present (CNP) TransactionsCNP transactions happen when the physical credit card and the cardholder aren’t there at the time and place of the transaction. As such, these transactions are more susceptible to fraud.

Businesses around the world lost $32.3 billion to fraud in 2021. Learn how to protect your online payments.

A credit card authorization form serves as an extra form of proof for CNP transactions. So, if you fight fraud or chargeback, you have proof of authorization to help make your case.

Business-to-Business (B2B) PaymentsTypically, B2B payments differ slightly from business-to-consumer (B2C) transactions. Payment preferences vary, and more businesses opt for “traditional” payment methods. Although paper checks and ACH deposits are more popular, they’re declining and losing ground to credit cards. Learn more about B2B payments.

Credit card authorization forms are especially handy for B2B payments. A few use cases include:

Chargebacks happen when your business charges a credit card and the cardholder tells their issuing bank that the charge was not authorized and should therefore be refunded.

It’s in every business’s best interest to avoid chargebacks. For starters, they cost an average of $240 for every $100 in chargebacks. If you get too many, your business accounts and financial reputation could be at stake. You could get removed from your merchant account and hurt your chance at future loan approvals.

When you use a credit card authorization form, just like in the case of fraud for CNP transactions, it helps validate the legitimacy of the charge. This means that you’re more likely to win the case and keep the money—unfortunately, however, there’s no way to get your time back. A credit card authorization form may also deter customers from pursuing chargebacks in the first place. Learn more about chargebacks.

You can use credit card authorization forms in hard copy or digitally. For in-person transactions, it’s a good idea to have several hard copies available.

For transactions that don’t happen in person, you can mail a physical copy or email a digital copy of the credit card authorization form, so the customer can fill it out and send it back on their own time. They can print it out and sign or sign digitally with a tool like DocuSign or HelloSign.

Now, small business technology is advancing to the point where you can offer digital credit card authorization forms in person, too. If you have tablets set up at your place of business, customers can easily fill out the forms.

The information being asked for on credit card authorization forms is more or less the same, but not all information is mandatory. Some include optional fields specific to the product or service. More information offers businesses more security and validation, but bear in mind how collecting this information may impact the customer experience. While someone buying a car may be willing to provide all of this information, it may be overkill for a smaller purchase.

Mandatory Credit Card Authorization Information Optional Credit Card Authorization InformationEvery business that accepts noncash transactions is expected to observe Payment Card Industry Data Security Standard (PCI DSS) compliance standards to avoid liability in case of data breach. This includes policies on how to store and manage credit card authorization forms. Note that payment processors and merchant account providers expect businesses to remain PCI-compliant or be assessed for noncompliance fees that start at $19.95 per month.

Here are the PCI guidelines for storing credit card authorization forms:

There are a few types of credit card authorization forms, and you may want to choose one over the other depending on your business type. We provided our standard payment authorization form above, which you can use if you process both single payment and recurring credit card or ACH (direct-to-bank) transactions.

Click through the sections below for additional free credit card authorization form templates.

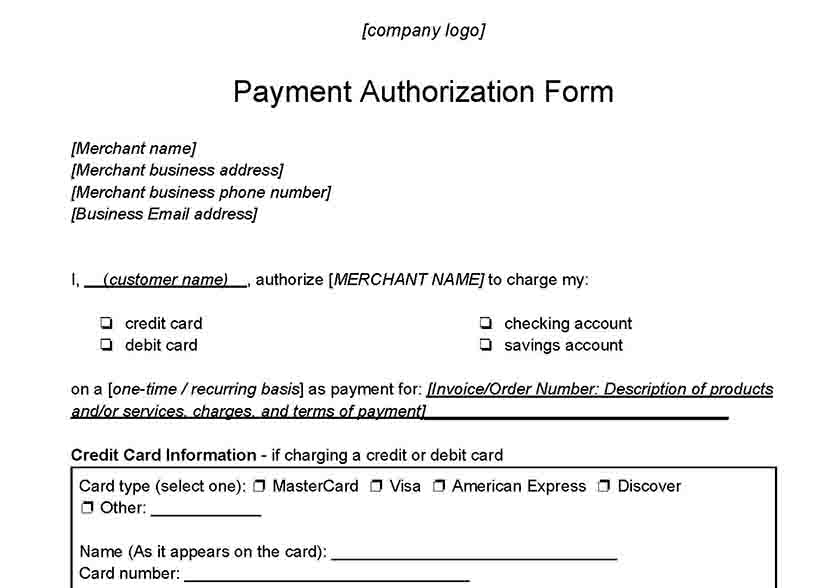

Use this credit card authorization form template if your business requires future one-time credit card transactions.

FILE TO DOWNLOAD OR INTEGRATE

Single Payment Card Authorization Form